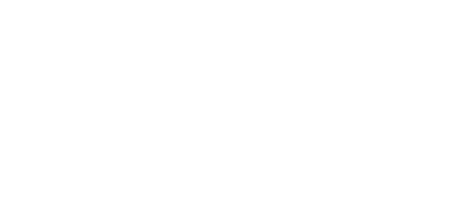

In the current regulatory landscape, global financial organizations must make significant investments in anti-money laundering (AML) and anti-terrorism controls (CFT) leading them to follow a client identification procedure of Customer Due Diligence (CDD) or Know Your Customer (KYC). ID Verification helps banks provide a smooth customer onboarding experience that complies with KYC regulations and minimizes the risk of fraud.

Orchestrate the optimal customer journey

- Fully compliant with latest Bank of Greece regulations

- End-to-end solution including video call

- Modular solution – can be connected to any existing processes

- Mobile Channel fully supported (NFC Technology)

- Fastest solution available

Features

Thales’s ID verification solution automatically performs, in a few seconds, the three verification actions required to identify a customer and it also allows a real-time enrollment in any configuration. It is a fully flexible solution that can be easily deployed across subsidiaries and branches.

Solution in a nutshell

Remote KYC/IDV (SaaS in the cloud)

-

Web/Mobile IDV Level 1 and FR (via ICAO Certified documents)

Liveness detection featured

ID/Passport Advanced Security checks & data extraction - Customer Due Diligence and Risk Assessment (via DowJones Watch List)

- Accompanied Documents OCR and Management

- Remote issuing of eIDAS Qualified Certificate

- Remote eIDAS Document Signing and Management

Our solution automatically provides, in a matter of seconds:

- digital capture of customer information for instant auto-fill in enterprise data systems

- multichannel identity document verification, with adaptable security levels

- option of customer authentication using biometric technologies

- option of customer risk assessment through the review of PEPs, sanctions or watch lists

Digital Onboarding solution offers organizations various services depending on local regulations and IT infrastructure:

- Off-line ID Verification with Back-office services

- Video Call services for extra security checks and liveness

- Uploading of extra accompanied documents to support remote on-boarding

- Remote issuing of Qualified Certificate to support Remote Digital Signing under eIDAS regulation

Indicative Process Flow

Features

Mellon in partnership with Thales’s ID verification solution, automatically performs, in a few seconds, the three verification actions required to identify a customer and it also allows a real-time enrollment in any configuration. It is a fully flexible solution that can be easily deployed across subsidiaries and branches.

Our solution automatically provides, in a matter of seconds:

- digital capture of customer information for instant auto-fill in enterprise data systems

- multichannel identity document verification, with adaptable security levels

- option of customer authentication using biometric technologies

- option of customer risk assessment through the review of PEPs, sanctions or watch lists

Digital Onboarding solution offers organizations various services depending on local regulations and IT infrastructure:

- Off-line ID Verification with Back-office services

- Video Call services for extra security checks and liveness

- Uploading of extra accompanied documents to support remote on-boarding

- Remote issuing of Qualified Certificate to support Remote Digital Signing under eIDAS regulation

Use Cases

- Digital customer on-boarding (non-customers, FI’s, SME’s)

- Online authentication and eIDAS QES Issuing and enabling - Act as a TSP (Trust Service Provider) in compliance with directive of July, 2017 and eIDAS

- Remote Signing of documents – Digital Transformation

- Regular Update of customer details for High-Risk Customers / Better risk assessments and compliance with AML4-5/CFT

Unique Advantages

STRONG MARKET PRESENCE & EXPERIENCE

- Local offices and Support in SEE

- Consulting on Compliance issues (eIDAS, AML, PSD2)

- Huge experience in Outsourcing and CCS

- Global partners and cutting edge technology

UNIQUE eIDAS CERTIFIED SERVICE

- Certification by EU Conformity Assessment Body

- Agents/Validators Trained on identification of fake documents

- Fast digital on-boarding, Secure IDV results

RICH FUNCTIONALITY

- IDV Methods: Automated L1 and L2 IDV, Video Call with Interactive Sales Capabilities, Hybrid IDV and KYC

- TECH: Auto Liveness Detection and Biometric Face Recognition // Agents-Validators anti-fraud Techniques // Qualified Certificates enrolment and Issuing (short and long lived, for retail and companies) // OCR and ICR

- DOCS: ICAO Documents of more than 200 countries // Non-ICAO ID Documents // Extra Documents management (i.e. utility bills)

As compared with other biometrics systems using fingerprint/palmprint and iris, face recognition has distinct advantages because of its non-contact process. Face images can be captured from a distance without touching the person being identified, and the identification does not require interacting with the person. In addition, face recognition serves the crime deterrent purpose because face images that have been recorded and archived can later help identify a person.

nShield HSMs provide a hardened, tamper-resistant environment for secure cryptographic processing, key generation and protection, encryption and more. Available in three FIPS 140-2 certified form factors, nShield HSMs support a variety of deployment scenarios.

Designed for the payment industry, payShield HSMs are proven solutions that deliver capabilities for issuing credentials, processing transactions and managing keys. Thales e-Security payment HSMs are the most widely deployed in the world, used in an estimated 80 percent of payment card transactions. payShield 9000 supports payment applications for contact chip, contactless chip and mobile secure elements. The solution addresses evolving standards from EMVCo, PCI SSC, GlobalPlatform and Multos International.

Thales hardware security modules (HSMs), both payShield 9000 and nShield, are already helping PSPs to deliver secure mobile point-of-sale (mPOS) solutions to large numbers of merchants, some accepting card payments for the first time. The HSM performs three critical functions for PSPs – managing keys for the card readers, decrypting the encrypted transaction data received from the merchants and translating the PIN blocks for online PIN-based transactions. payShield 9000 meets all the relevant payment security certification standards (FIPS 140-2 Level 3 and PCI HSM) in addition to supporting various algorithms and key management methods used in mPOS transactions – with the ability to add custom functions to meet individual PSP requirements if necessary.

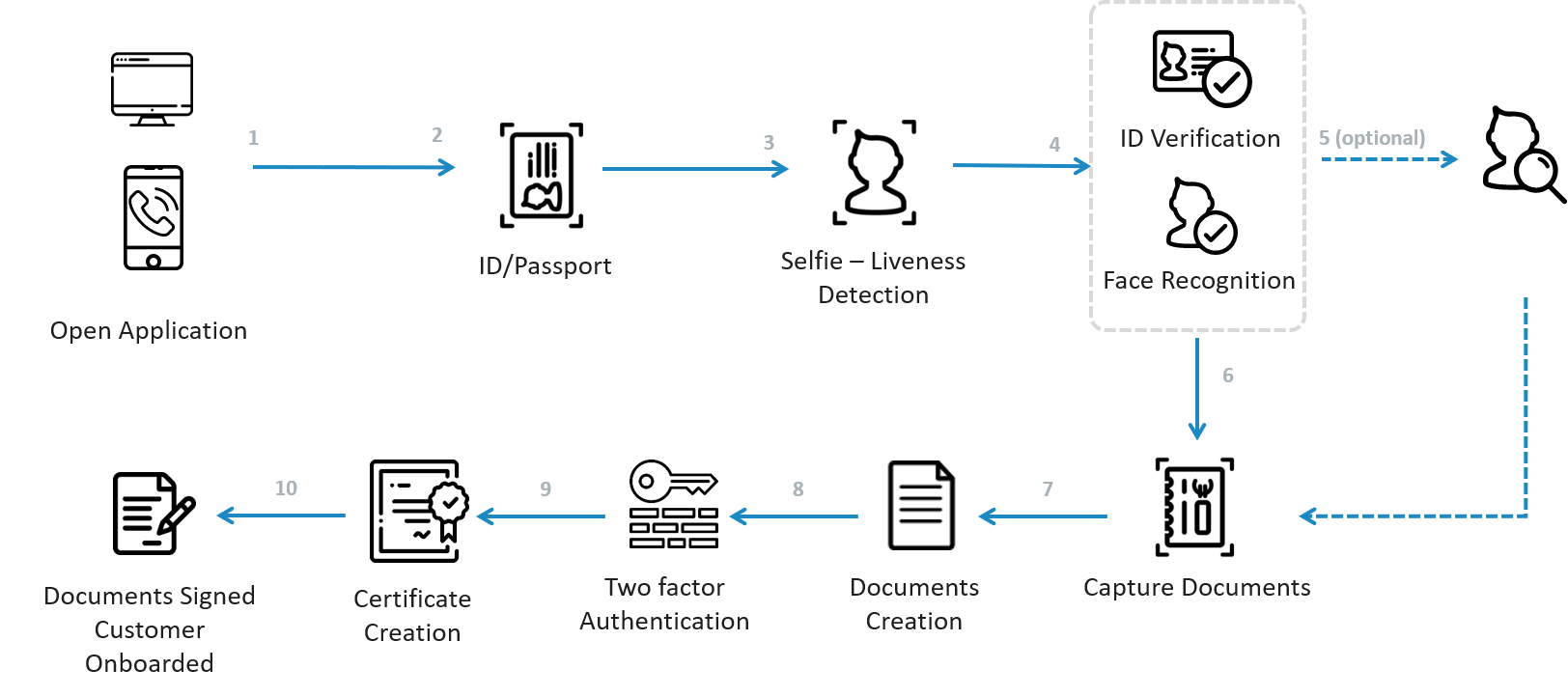

The ePIN Solution is implemented within the PCI zone of the issuing organization and the auditor examines the end-to-end process of issuing, including PIN delivery. Given the long experience and extended technical expertise on security best practices and PCI DSS compliance, the ePIN solution has been designed “from the ground up” to take into account PCI DSS requirements and Card Schemas standards for secure transmission of PINs via electronic methods, and delivers maximum possible security in its implementation, operation and administration.

Benefits

- Considerable cost savings from paper, printing equipment, maintenance and postal expenses

- Fast implementation

- Speed – card holder no longer has to wait for days for their PIN mailers to be delivered, making the solution ideal for instant issuing

- PIN delivery is made with maximum security

- Easy adaptation to bank systems & workflows

- Simplifies the card activation process for card holders, simultaneously providing an increased sense of security

- Improves Eco profile – no paper is used

From risk management to strong user authentication and transaction signing, Ezio solutions secure all eBanking and eCommerce use cases. By offering frictionless, convenient, and robust authentication, Gemalto’s eBanking solutions protect online banking customers from external attacks and guarantee an ideal balance between a user-friendly, and secure online experience.

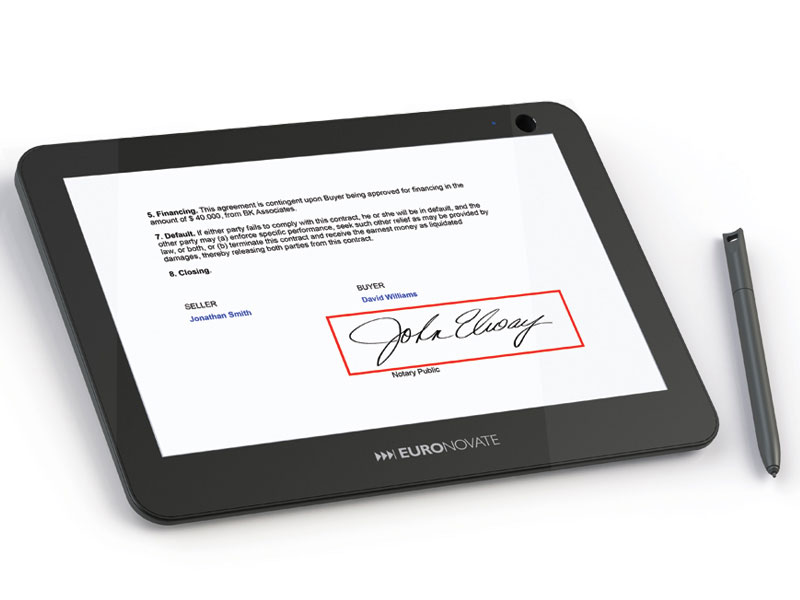

It includes 14 modules that, in addition to the “base” version (ENSoft core module), allows the use of Euronovate devices in the best possible way, not only for the signature but also for marketing activity and data-entry on the costumer’s side.

The solution was developed to allow quick and easy integration with the systems already in use by the customer. The provided SDK, or any available plug-in, allows the customer to experience the signature of his documents just a few hours after the first installation. EnSoft uses the Device as a separate object from the PC because it includes a FW, and an entire SW chain, and the return of the PDF ready for storage.