Through strategic partnerships (Gemalto, Thales, Strands, Fiserv, Euronovate) and infrastructure investments (Strong Customer Authentication and Know Your Customer SaaS HUB) we offer value to the below areas, allowing banks to focus their resources on building use cases for great customer experience and convenience and rest assured that security, compliance and future evolution are granted by industries’ leading technology suppliers.

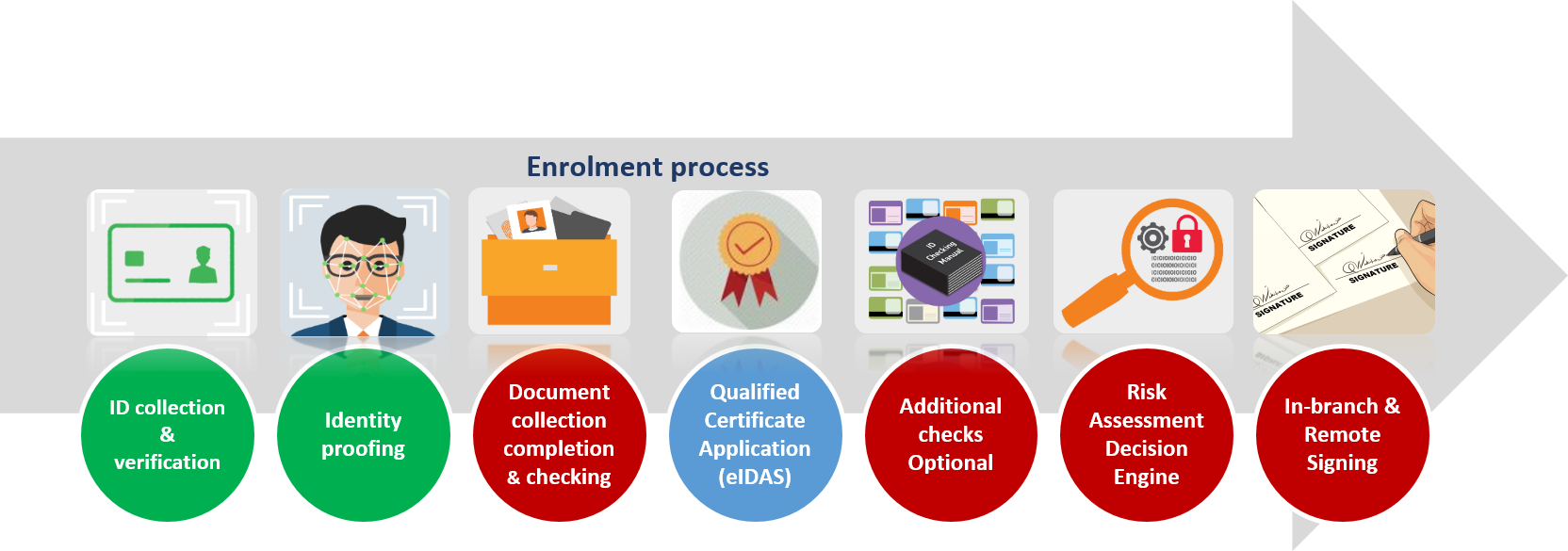

- A flexible solution ID Verification Solution offers a modern and flexible software system, which easily integrates into customer’s business processes, delivering a secure and reliable customer on-boarding experience.

- Multi-Level of Verification ID Verification offers different service levels of verification (Level 1, Level 2, and option -e) in accordance with the underlying document type (electronic vs non-electronic) and with the available document capture infrastructure deployed.

- Multi-channel Document Verification System able to support online, in-branch, across different front-ends such as smartphones, tablets, PC, Scanners and/or Full-page document scanners, capable of scanning document under a wider light spectrum (White, Infra-red and Ultraviolet).

- Extensive Document Support ID Verification Solution supports the widest worldwide Identity Document Template Database, covering the verification of over 1500 active identity documents. The extensive knowledge of identification documents from Gemalto’s global passport & ID cards production, coupled with a comprehensive coverage of all other document types, such as foreign driver licenses and resident permits forms the foundation of the verification solution. The database continue to grow and receives updates at least monthly with documents that have been recently released or updated. Template Database can be expanded rapidly.

- Future-proof solution Identity documents visual and electronic security features are constantly evolving, aiming to efficiently combat fraud activities. Gemalto, as the world leading provider of identity documents, actively participates in the elaboration and evolution of such industry standards, which ensures that ID Verification services meets with the latest security features and standards.

-

Achieve Compliance with

- AML4 (Directive EU2045/849 & Directive 2005/60/EC of the European parliament and of the council) - in force as of June 2017

- Customer Risk Management for AML5 and CFT – Countering the Financing of Terrorism (i.e. PEP, sanction lists, other lists, etc.)

Remote & in-branch KYC (Know Your Customer) and ID Verification – eIDAS

- Level-1 IDV via Video Conference and/or Biometric Face Recognition

- Level-2 IDV via professional ID scanners (airport control level)

- Cross check with local Governmental ID proofing lists and Tax Lists

- Unattended KYC and Debit Card Instant Issuing via Gemalto mini-Kiosks

- Remote Issuing of Qualified Certificates under eIDAS

- Remote and in-branch Digital Signing with advanced or Qualified Certificates (PKI)

- Remote Customer on-Boarding & Digitization of customer’s banking processes; from enrolment to new-services to signing of contracts and transactions (consumers, Merchants, SME’s)

Customer Risk Assessment and Due Diligence - AML4-5 & CFT (Anti-Money Laundering & Countering the Financing of Terrorism)

- Via DOWJONES Watch Lists

- Via custom lists

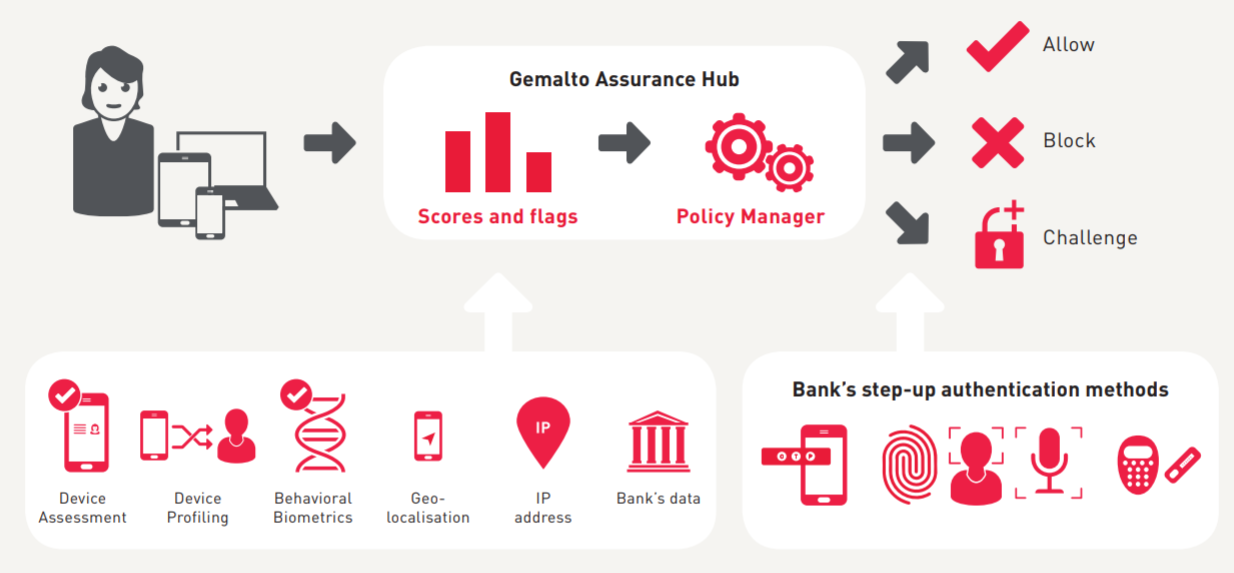

Το GAH είναι διαρθωμένο και μπορεί εύκολα να ενσωματωθεί στις ήδη υπάρχουσες λύσεις διαχείρισης κινδύνων και τους επιχειρηματικούς κανόνες της τράπεζας. Χάρη στη διεπαφή ενιαίου σημείου που διαθέτει, εξαλείφει την πολυπλοκότητα και προσφέρει βελτιστοποιημένη εμπειρία χρήστη. Με τον τρόπο αυτόν ελαχιστοποιείται ο κίνδυνος απάτης, ενώ με την κονσόλα ελέγχου είναι δυνατή η δοκιμαστική εκτέλεση διάφορων στρατηγικών απάτης και μεθόδων επαλήθευσης βάσει κινδύνου.

Γιατί το GAH αποτελεί την ιδανική λύση

- Μία API κλήση για πολλές υπηρεσίες: παρέχει πρόσβαση σε πολλαπλές προελεγμένες τρίτες υπηρεσίες πρόληψης απάτης τις οποίες διαχειρίζεται η Gemalto.

- Gemalto Rule Set: reduces set up time as well as leverages fraud prevention trends across multiple financial institutions

- Standard Input & Output: what you send and receive from Gemalto remains consistent regardless of vendors used and/or changed to

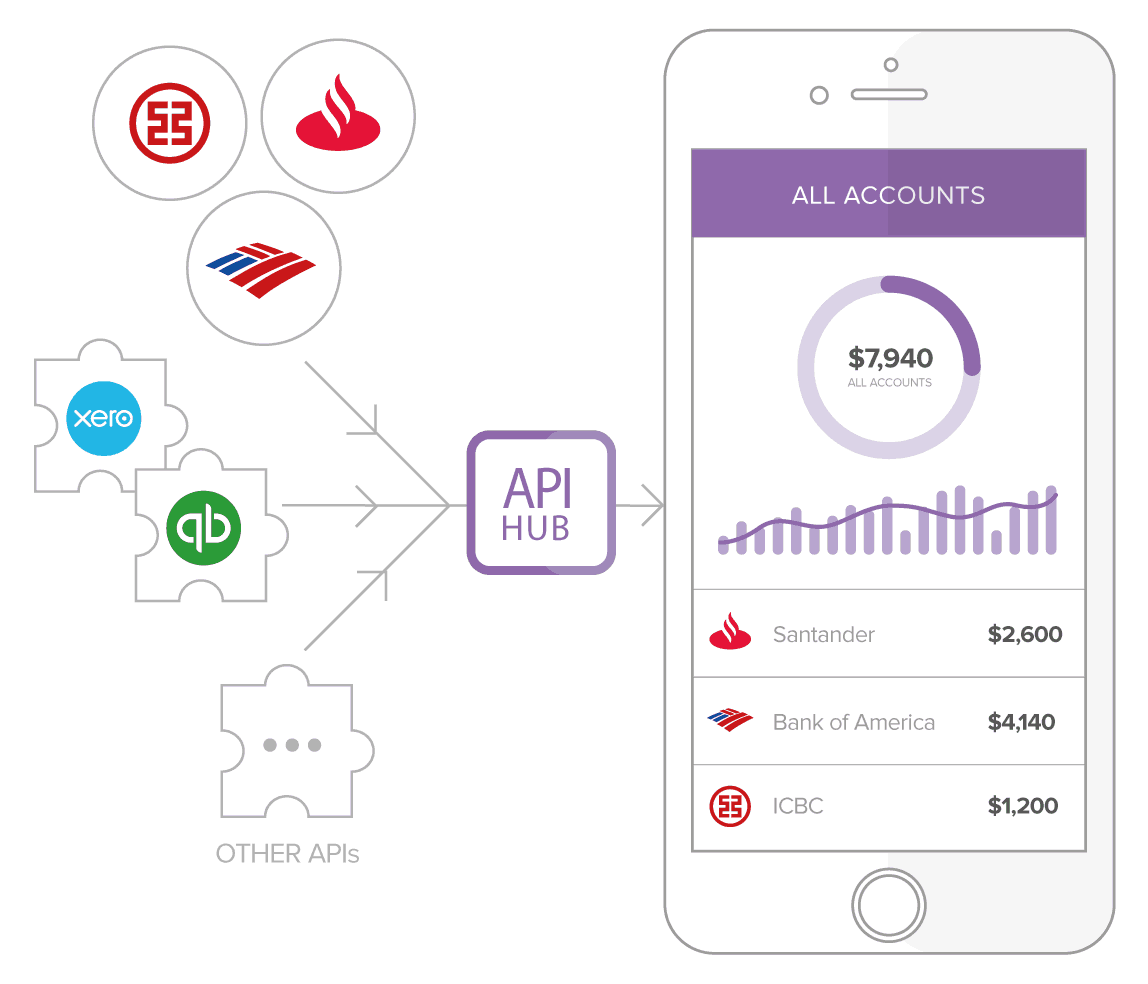

Why API HUB

- Become the customer’s primary bank and retain a greater number of clients.

- Achieve a 360º perspective of customer behavior, more accurate segmentation, and the ability to cross-sell and upsell more effectively.

- Centralized, homogeneous and cleaner customer data with the best accuracy on the market

- We deliver solutions to large organizations that are among the most innovative in the world

The Strands Finance Suite includes a comprehensive set of white-label solutions such as PFM, BFM, CLO & REC, all based on Big Data Analytics and Machine Learning.