Remote Digital Onboarding & Know Your Customer (KYC eIDAS compliant with AML4)

In the current regulatory landscape, global financial organizations must make significant investments in anti-money laundering (AML) and anti-terrorism controls (CFT) leading them to follow a client identification procedure of Customer Due Diligence (CDD) or Know Your Customer (KYC). ID Verification helps banks provide a smooth customer onboarding experience that complies with KYC regulations and minimizes the risk of fraud.

Orchestrate the optimal customer journey

- Fully compliant with latest Bank of Greece regulations

- End-to-end solution including video call

- Modular solution – can be connected to any existing processes

- Mobile Channel fully supported (NFC Technology)

- Fastest solution available

Solution in a nutshell

Remote KYC/IDV (SaaS in the cloud)

-

Web/Mobile IDV Level 1 and FR (via ICAO Certified documents)

Liveness detection featured

ID/Passport Advanced Security checks & data extraction - Customer Due Diligence and Risk Assessment (via DowJones Watch List)

- Accompanied Documents OCR and Management

- Remote issuing of eIDAS Qualified Certificate

-

Remote eIDAS Document Signing and Management

Features

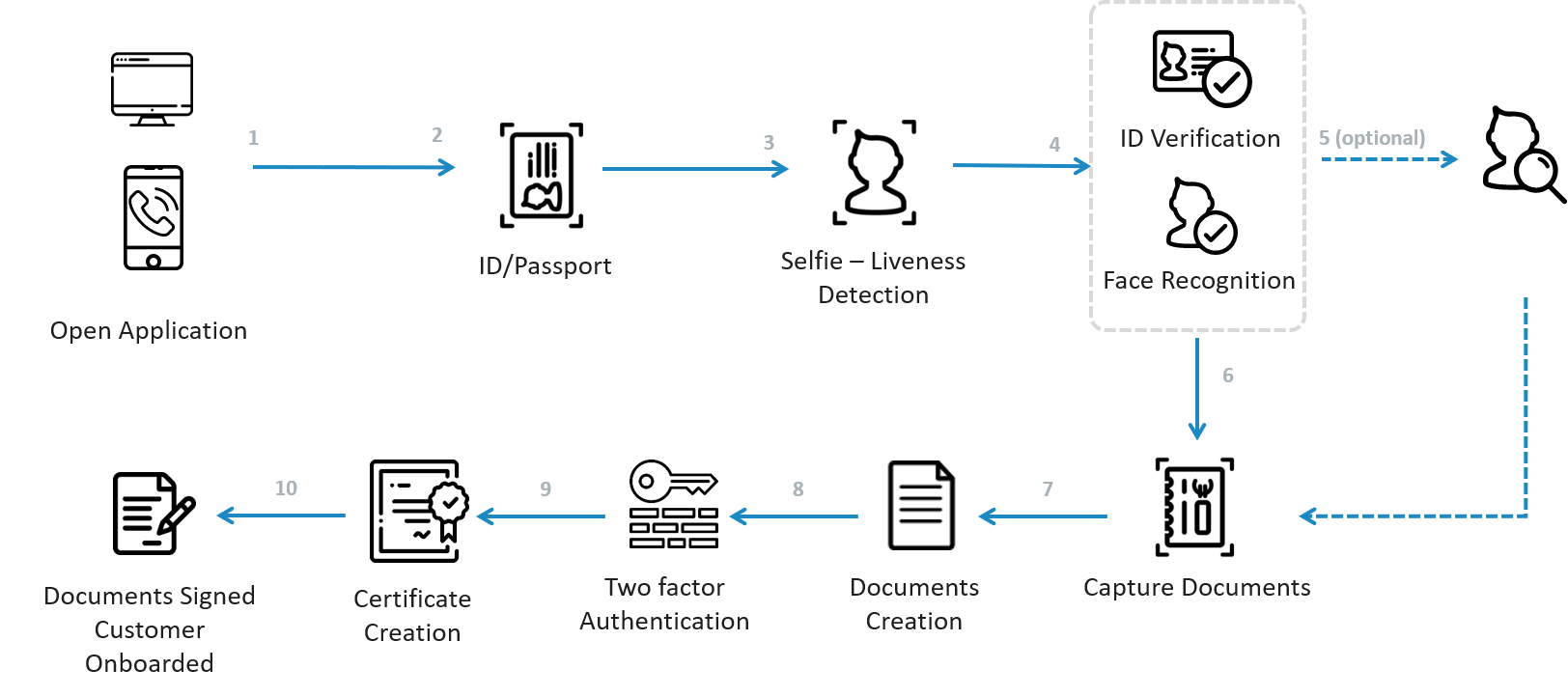

Mellon in partnership with Thales’s ID verification solution, automatically performs, in a few seconds, the three verification actions required to identify a customer and it also allows a real-time enrollment in any configuration. It is a fully flexible solution that can be easily deployed across subsidiaries and branches.

Our solution automatically provides, in a matter of seconds:

- digital capture of customer information for instant auto-fill in enterprise data systems

- multichannel identity document verification, with adaptable security levels

- option of customer authentication using biometric technologies

- option of customer risk assessment through the review of PEPs, sanctions or watch lists

Digital Onboarding solution offers organizations various services depending on local regulations and IT infrastructure:

- Off-line ID Verification with Back-office services

- Video Call services for extra security checks and liveness

- Uploading of extra accompanied documents to support remote on-boarding

- Remote issuing of Qualified Certificate to support Remote Digital Signing under eIDAS regulation

Use Cases

- Digital customer on-boarding (non-customers, FI’s, SME’s)

- Online authentication and eIDAS QES Issuing and enabling - Act as a TSP (Trust Service Provider) in compliance with directive of July, 2017 and eIDAS

- Remote Signing of documents – Digital Transformation

- Regular Update of customer details for High-Risk Customers / Better risk assessments and compliance with AML4-5/CFT

Unique Advantages

STRONG MARKET PRESENCE & EXPERIENCE

- Local offices and Support in SEE

- Consulting on Compliance issues (eIDAS, AML, PSD2)

- Huge experience in Outsourcing and CCS

- Global partners and cutting edge technology

UNIQUE eIDAS CERTIFIED SERVICE

- Certification by EU Conformity Assessment Body

- Agents/Validators Trained on identification of fake documents

- Fast digital on-boarding, Secure IDV results

RICH FUNCTIONALITY

- IDV Methods: Automated L1 and L2 IDV, Video Call with Interactive Sales Capabilities, Hybrid IDV and KYC

- TECH: Auto Liveness Detection and Biometric Face Recognition // Agents-Validators anti-fraud Techniques // Qualified Certificates enrolment and Issuing (short and long lived, for retail and companies) // OCR and ICR

- DOCS: ICAO Documents of more than 200 countries // Non-ICAO ID Documents // Extra Documents management (i.e. utility bills)